FEES AND LIVING EXPENSES

- Sponsorship Fee: $0 – Teacher does not pay the sponsorship fee with CHF

- Recruitment fees: $0 – no charge for recruitment and CHF does not work with recruitment agencies

- US Government Fees:

- I-901 SEVIS (Student and Exchange Visitor Information System) fee: $220 (payable to SEVIS)

- Embassy Fee: $185 (payable when scheduling US Embassy appointment)

- Public or Charter school districts Initial Teacher License – $100-$250

- Background check through IdentoGO – $59

- Credential evaluations, translations, or other document services: $185- $400

FOREIGN CREDENTIALING AGENCIES

- Foundation for International Services, Inc.: www.fis-web.org

- Spantran – They offer discounts and a 10, 5, and 2-day turnaround time: www.spantran.com

- Academic Credential Evaluation Institute.

- Center for Applied Research, Evaluation, and Education, Inc.

- Educational Credential Evaluators, Inc.

- Global Credential Evaluators, Inc.

- International Education Evaluations – They offer discounts and a 5-day turnaround time.

- International Education Research Foundation

- World Education Services

TEACHER LICENSURE COSTS – example: New York State where CHF is domiciled

The fees associated with licensure application in NY state can be broken down into four basic categories:

1. Application Assessment Fee – $50/$100

|

This is the fee charged by the New York State Education Department (NYSED) to cover the cost of reviewing your application materials. Amounts vary according to the type of certification you are seeking and whether or not you have completed an NYS-approved training program:

- $50 – Initial certificate review for candidates from NYS-approved programs

- $100 – Initial certificate review for candidates from non-NYS-approved programs (requires individual transcript evaluation)

Initial certificates are valid for five years, at which time you will need to apply for a professional certificate.

2. Test Fees – $689

|

The New York State Teacher Certification Examination Program (NYSTCE) uses Pearson Education for test administration. Your scores for the New York-specific tests will be automatically reported to the New York Office of Teaching Initiatives when available, and you can request to have your edTPA score electronically forwarded at the time of testing.

Here are the test fees for the New York state certification exams:

- Academic Literacy Skills Test (ALST) – $118

- Educating All Students (EAS) – $92

- Multi-Subject CST (childhood grades 1-6) – $179 (if all three parts are taken at one sitting)

The edTPA is administered for multiple states, so be sure to select the test applicable to New York when registering.

- edTPA fee – $300

3. Workshop Fees – $75/$133 (approximate)

|

The fees for the mandatory workshops can vary greatly depending on the vendor offering the training. Here are some sample costs, and if you click on the workshop title, you will find a list of approved vendors for that workshop:

- Dignity For All Students Act (all applicants) – $75 from the Center for Spectrum Services

- Child Abuse Identification (non-approved program applicants only) – $29 from Abused Child Research Associates

- School Violence Intervention and Prevention (non-approved program applicants only) – $29 from Abused Child Research Associates

4. Fingerprint Clearance and Misc Fees – $102+

|

New York requires a background check, including fingerprint clearance, for teacher licensure. This is contracted with MorphoTrust and includes the following costs:

$ 75.00 – DCJS Fee

$ 14.75 – FBI Fee

$ 12.25 – MorphoTrust administrative Fee

$102.00 – Total Fingerprint Clearance Cost

A list of locations in New York can be found here. This must be done in person; also be sure to check out the required documentation you’ll need to bring to your appointment.

You may encounter a few other additional costs associated with New York teacher licensure depending on your situation. These could include expenses for things like transcript requests (some schools charge a fee and others do not); postage; transportation to workshops, tests, and appointments; or fees to obtain necessary proof of identity if you do not have it for your background check.

The Bottom Line

The expenses involved with becoming a teacher don’t end with the receipt of your diploma! If you’re an elementary education teacher seeking initial licensure in the state of New York, here’s approximately what you can expect to pay:

- $916 with completion of an NYS-approved program

- $1024 with the completion of a non-approved program

For detailed information regarding the entire process or to apply, go to Certification from Start to Finish on the New York State Education Department website.

INSURANCE

The Cordell Hull Foundation covers Repatriation and Medical Evacuation insurance free of charge for all J-1 teachers and J-2 dependents (spouse or child only).

In addition, it is the teacher’s responsibility to make sure that they have medical insurance coverage with the following minimum benefits, during their entire stay in the US, from the moment they set foot on US soil, either through the school district or with independent J-1 teacher visa insurers:

- Medical benefits of at least $100,000 per accident or illness.

- Repatriation of remains in the amount of $25,000.

- Expenses associated with the medical evacuation of the exchange visitor to his or her home country in the amount of $50,000.

- A deductible not to exceed $500 per accident or illness.

Examples of J-1 visa health insurance providers.

Check websites for current fees, ranging from ~$50-$125/mo per person (J-1 teacher + J-2 dependents):

IMG Global: Imgglobal.com

J1 Visa Health Insurance – Visitor Guard

American Visitor Insurance.com

After the school or district initiates the process for teachers to be sponsored by CHF, we provide specific instructions on how to fulfill the health insurance requirement. About one-third of our teachers buy their own insurance through an outside independent J-1 health insurance provider. Many connect the national health insurance of their governments to an International Rider that allows them to be covered in the United States. Many are covered by their own school or school district group health insurance plans, which are entirely covered 100% (in progressive cities like New York City) or partially covered, an arrangement that allows the teacher to pay a much reduced premium. Foreign teachers and schools are enabled to enroll in their own American school group plans by the Cordell Hull Foundation’s free insurance coverage of the medical evacuation and repatriation for all J-1 teachers and J-2 dependents.

ESTIMATED LIVING EXPENSES WHILE IN THE UNITED STATES

The cost of living varies widely depending on the region where you live. Larger cities tend to be more expensive, such as New York City, San Francisco, and throughout Silicon Valley–a strip of cities lining the Camino Real just south of San Francisco extending to San Jose, California.

Below are averages for a single person PER MONTH and may or may not apply to your planned living situation. However, each individual teacher is given a complete Cost of Living Estimate by the Cordell Hull Foundation at the time the J-1 visa papers are emailed for the specific area.

- Housing: $1,000 – $3,000

- Local transportation: $400 – $700

- Food: $400 – $800

- Utilities: $150 – $300

- Cell phone: $50 – $100

- Clothing: $100 – $500

- Travel / Entertainment: $250 – $500

- Medical including insurance deductibles: $200 – $600

- Cable and Internet: $50 – 300

- Childcare: $600 – $1,000 (per child)

POTENTIAL WORK-RELATED PAYCHECK DEDUCTIONS

These deductions will vary depending upon salary and school district and would be reflected in your current employment agreement.

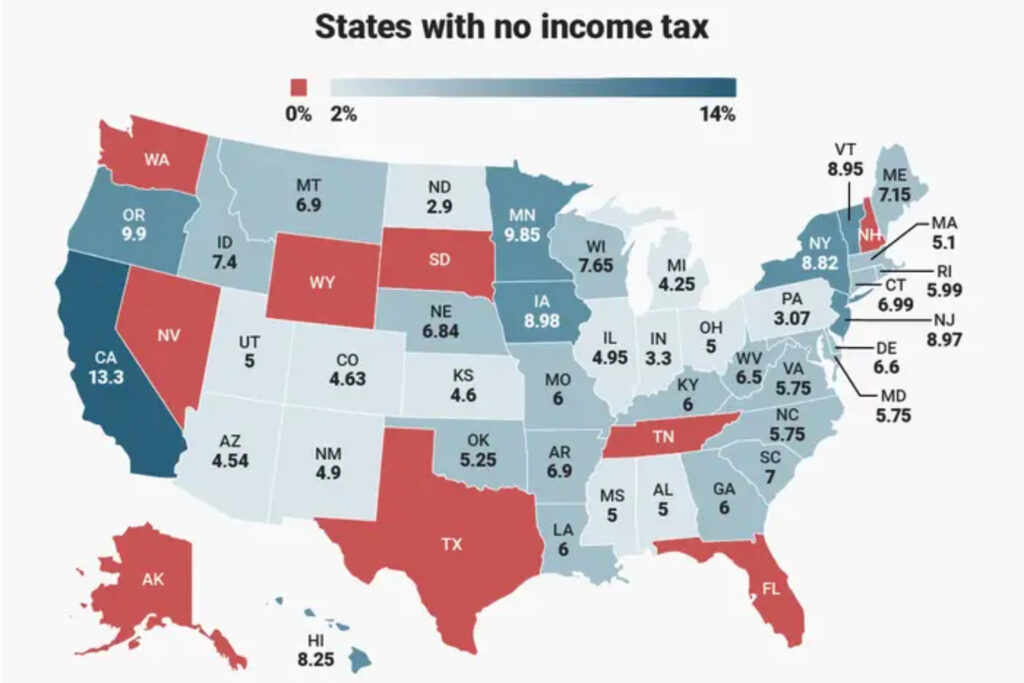

- Federal and state income tax withholding (required for all J-1 program participants)

- FEDERAL: 14.6% to 27.3% depending upon your salary amount and the state you live in. Unless your home country has a tax exemption, If you make $90,000 a year living in the region of New York, USA, you will be taxed $24,534. That means that your net pay will be $65,466 per year, or $5,456 per month. Your average tax rate is 27.3%.

- 2024 tax brackets and income tax rates

- There are seven income tax rates for the 2024 tax year, ranging from 10% to 37%. The tax brackets for each filing status, which show how much of someone’s taxable income is subject to a particular rate, are up 5.4% from 2023. This could mean lower taxes for those whose income has stayed the same since last year.

- The 2024 tax brackets apply to income earned this year, which is reported on tax returns filed in 2025.

2024 Federal Income Tax Brackets and Rates for Single Filers, Married Couples Filing Jointly, and Heads of Households

| Tax Rate | For Single Filers | For Married Individuals Filing Joint Returns | For Heads of Households |

|---|---|---|---|

| 10% | $0 to $11,600 | $0 to $23,200 | $0 to $16,550 |

| 12% | $11,600 to $47,150 | $23,200 to $94,300 | $16,550 to $63,100 |

| 22% | $47,150 to $100,525 | $94,300 to $201,050 | $63,100 to $100,500 |

| 24% | $100,525 to $191,950 | $201,050 to $383,900 | $100,500 to $191,950 |

| 32% | $191,950 to $243,725 | $383,900 to $487,450 | $191,950 to $243,700 |

| 35% | $243,725 to $609,350 | $487,450 to $731,200 | $243,700 to $609,350 |

| 37% | $609,350 or more | $731,200 or more | $609,350 or more |

STATE: No country has a tax exemption for state taxes. If you make $35,000 a year living in the region of Florida, USA, you will be taxed $5,118. That means that your net pay will be $29,882 per year, or $2,490 per month. Your average tax rate is 14.6%. Florida has no state tax.

- Social Security, Medicare (FICA) ETC. – J-1 visa holders are exempt for the first year and a half. Afterwards, the deduction is 6.2%.

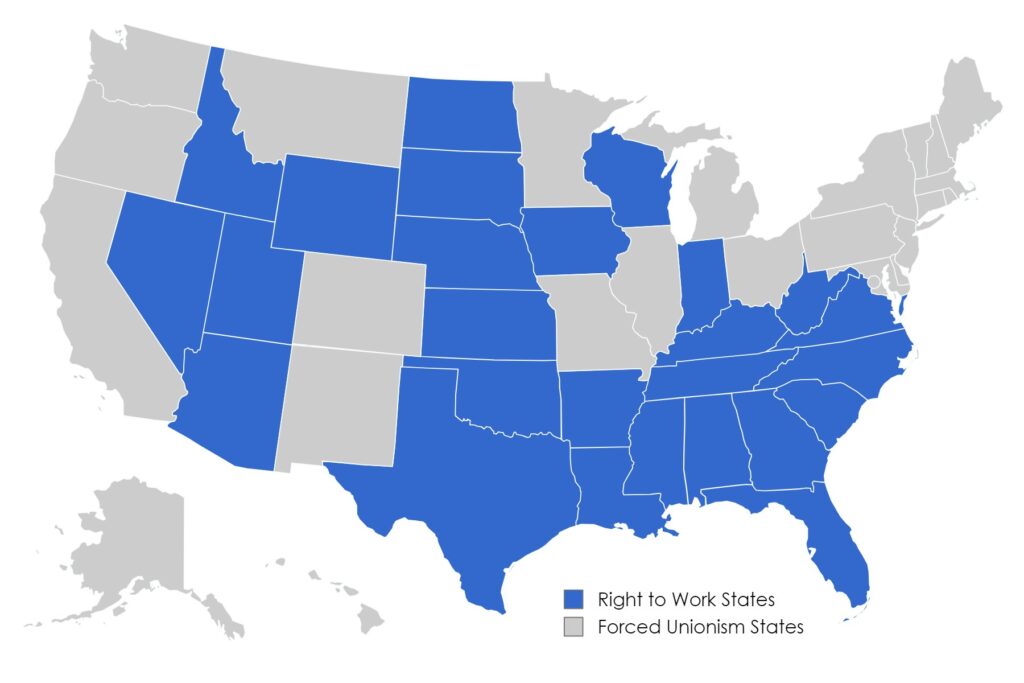

- Union dues in 26 states that are not Right-to-Work: (variable): $50 – $150/month

- Retirement benefit deductions – vary according to individual school district. Deductions may not start until the second year of service. Examples:

- New York Public Schools: www.nystrs.org/benefits/service-retirement – 8.25% of paycheck

- Click on CALCULATIONS according to salary and tenure – phone (800) 348-7298

- Texas Public Schools: https://www.trs.texas.gov – 7.7% of your paycheck is deducted

- California Public Schools: 8% of earnings in excess of one year of service

CalSTRS https://www.calstrs.com › contributions

- New York Public Schools: www.nystrs.org/benefits/service-retirement – 8.25% of paycheck

- Health Insurance (See above for J-1 program insurance requirements).

The following is a list of each state’s licensing requirements: